Asking For Waiver Of Penalty - Request For Waiver Of Penalty Deposit Doc Template Pdffiller / Select the tax type at the.

Asking For Waiver Of Penalty - Request For Waiver Of Penalty Deposit Doc Template Pdffiller / Select the tax type at the.. Waiver of penalties on vehicles sold at wholesale auction (cvc §9561.5). Income tax individual or vat, then select. The irs will not waive the penalty on the phone. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. The irs only removes penalties incurred in the first year.

Here is how to apply for waiver of kra's penalties and interest using the itax system click on the apply for waiver for penalties and interests, under the page choose applicant type as taxpayer, and select tax obligation e.g. You didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty. To know whether you have a kra penalty, just log into your kra itax account; To apply for a penalty waiver for any other taxes administered by the department that are not currently filed on tntap, you should fully complete a penalty waiver. As with most penalties, one way to reduce or eliminate the penalty is to reduce the underlying tax bill.

Waiver of penalties on vehicles sold at wholesale auction (cvc §9561.5).

Information about making a request to the cra to cancel or waive penalties or interest. Interest is never waived fdor agents are usually advised of the situation and are instructed to waive all penalties caused by the system issue. If you miss an rmd, you're subject to a 50% penalty on the amount you should have taken, and didn't. Casualty, disaster) for not complying with the tax laws, you may request a waiver of penalty (abatement of penalty). If you want to appeal a penalty about 'indirect tax' (for example vat if hmrc sends you a penalty letter by post, use the appeal form that comes with it or follow the instructions on the letter. If you have been charged a penalty but believe you have reasonable cause (e.g. The waivers of such penalties are therefore also conditional on a customer's payment history. Ask questions, get answers, and join our large community of tax professionals. He advised us not to pay the penalty, and ask for a waiver (we have a fairly good personal reason). Penalty waiver request, offer of compromise or protest. Where the civil penalty was already fully paid. Request to waive late fee letter. To apply for a waiver of penalty, please sign into your tennessee taxpayer access point (tntap) account.

A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. The penalty is only $144.00.but she was asking about this waiver for real estate agents not knowing. If you ask for a waiver for reasonable cause, you need to establish the facts for the issue you are having that keeps you from taking care of your however, if any penalties are reduced, the related interest is also reduced automatically. If you have been charged a penalty but believe you have reasonable cause (e.g. Finally, if all other means have been exhausted, consider contacting.

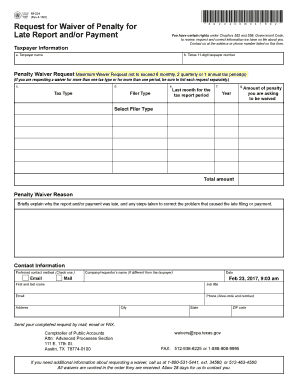

Waiver requests for late reports and payments.

Taxpayers do not need to make a request for the cancellation of penalties and interest if the deadlines were met. They always want the request to be in writing. The cra waived interest on tax debts related to individual, corporate, and trust income tax returns. That said, there is no guarantee that the issuing agency will give in to your request, but it never hurts to ask. You didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty. You can still ask for a waiver if you don't have reasons like those mentioned, but. (provide the bis invoice no. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Waiver of penalties on vehicles sold at wholesale auction (cvc §9561.5). The irs only removes penalties incurred in the first year. Under 'debt and enforcement', click on 'request for waiver of penalties and interests'. Information about making a request to the cra to cancel or waive penalties or interest. Dmv shall waive any penalties due for late payment of registration renewal fees penalties only shall be waived for late renewal for any period during which the registered owner was deployed to a location outside california.

You didn't previously have to file a return or you have no penalties for the 3 tax years prior to the tax year in which you received a penalty. It is going to take at least a couple of months to resolve the issue. If the waiver is denied, the penalties will be billed at a future date. In 2001, the irs established fta to help administer the abatement of penalties consistently and fairly, reward past compliance if the representative will not override it, ask for the representative's manager. It's a good idea to take a second look at your return if you have questions about your estimated tax penalty or need help explaining your circumstances to the irs to ask for a waiver or abatement, an.

Hello.,i am working in software company and because of my late opened salary account ,our company hr should draft letter for waiver of interest & penalty against notice and principal to pay?

Reasonable cause may exist when you show that you used ordinary business care and prudence and. But in the case of annual fees, surely it makes more sense for the banks to simply abolish them, since the banks know very well that customers will cancel the cards if the waivers are not granted. For instance, you may be given a citation, a penalty fee, or a new financial obligation. The penalty is only $144.00.but she was asking about this waiver for real estate agents not knowing. Waiver requests for late reports and payments. He advised us not to pay the penalty, and ask for a waiver (we have a fairly good personal reason). Income tax individual or vat, then select. Do you have questions about the open enrollment waiver process? The waivers of such penalties are therefore also conditional on a customer's payment history. Where the civil penalty was already fully paid. It's a good idea to take a second look at your return if you have questions about your estimated tax penalty or need help explaining your circumstances to the irs to ask for a waiver or abatement, an. Hello.,i am working in software company and because of my late opened salary account ,our company hr should draft letter for waiver of interest & penalty against notice and principal to pay? Finally, if all other means have been exhausted, consider contacting.

Komentar

Posting Komentar